In late December 2021, CBA head of Australian economics, Gareth Aird, forecast a 7% increase in property values in 2022 and a decrease of 10% in 2023. I’m sure he’s a very experienced economist, but after investing in property for 30 years and being an opinionated type, I can say with full confidence: you will not see a significant drop in the market in 2023.

I believe there will be strong growth until about 2025. I honestly think you could pick up a dart, throw it at a map of Australia and if you hit the map, there’s a good chance you’ll see price increases in that spot over the next three years (with the exception of Darwin and a few regional areas).

CoreLogic reports that Australia’s housing values are currently rising at the fastest annual pace since June 1989, having increased by 17.6% over the first nine months of 2021.

I’m likening what I’m seeing now to what happened between 1985 and 1988. Prices went up and they went up quickly – they almost doubled in three years. And then there was a sustained economic downturn. We can expect the equivalent of that in 2025 – 2026. That’s when I’ll look very strategically at my own property portfolio.

What else am I basing this on?

I’ve talked in an earlier blog about how important it is, when you’re buying investment property, to look at historical cycles and all kinds of economic reporting, from the Consumer Price Index to “The Skyscraper Index”. (Yes, it’s a thing!)

Below I’ve listed seven key factors that have contributed to my thinking. I’m not saying you should do as I do, but they should at least give you pause.

1. The investor market is yet to reach its peak.

We had our last investor peak in 2015. At time of writing we’re at 22.56% below.

2. We still haven’t opened up our borders.

What will happen when migrants start to enter the country after the COVID-19 travel bans are lifted? We might actually see a long-term growth issue in property.

3. Boom comes after a health crisis.

While we’re on the subject of COVID, post-pandemic times can be boom times. From 1921 to 1929, after the ‘Spanish Flu’ had ebbed, the US enjoyed a period of economic prosperity. There are signs recovery after COVID could mirror that – maybe not for the full eight years, and hopefully without a Great Depression at the end of it

4. We still have low interest rates..

Sure, they’ll go up – by 2026, I’m predicting Reserve Bank interest rates will probably be close to 3%, which means the banks will probably be operating closer to 5%. But remember that interest rates get dropped quickly to fix an economy but they also get raised very slowly to make sure they don’t hurt the economy.

5. Mortgage defaults have not yet started to happen. We do have mortgage stress happening in some areas, and home loan delinquencies are increasing. We are overspending as individuals and families, and governments. We’re borrowing too much

But remember that even when you start hearing news reports about people defaulting on their mortgage payments, it’s another 18 months to two years before the banks foreclose on their properties. It’s at THAT point, that you have a financial crisis brewing.

The banks dump property onto the market and consumer sentiment starts to drop. It’s the same thing that happened in the GFC.

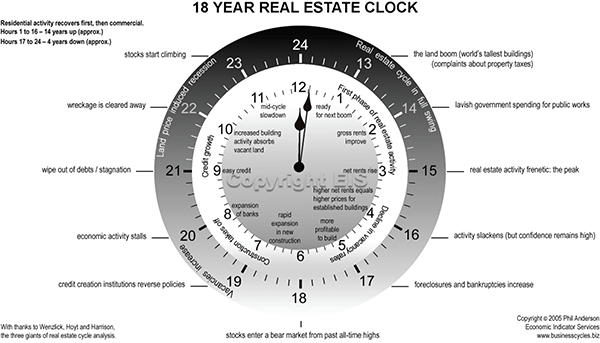

6. The latest 18.6-year property cycle is ending. This is Phil Anderson’s 18.6-year property cycle. Get to know it, and where we are in it

In my opinion, we’re currently sitting at about number 10, maybe 11. In 2025/2026, we’ll get to number 1 and see a sustained downturn: falling share prices, falling commodities, falling overseas reserves, tighter money. Falling real estate prices start at number 6.

I’m using mid 2025 as my yard stick. From there, we should expect about three and a half years of decreasing house prices. A word of warning: after 2026, if we do start to see a bit of sell off and some downturn, the banks and the government will do what they always do – they’ll try to lower interest rates.

7. A conversation my mate had with a tow truck driver. Market intelligence can come from anywhere. A friend had to get his car towed, and the tow truck driver said he’s busier than he’s ever been, towing lots of repossessed cars back to leasing companies. The next logical step, after you can’t afford your car payments, is you default on your personal loans. And then, when interest rates rise, it’s time for mortgage defaults. As per point 5 above, there are mortgage defaults in our future, but just not yet.

Why not hang on a bit longer, maybe until 2027?

I would much rather, in the (paraphrased) words of Steve McKnight, sell my property portfolio when it’s undervalued by a little bit, than have to sell it when it’s worth nothing.

That’s not to say that in this property cycle it will be worth nothing. But you will have some buying power at that point, so get ready.

And my last piece of investing advice: be a buyer with some integrity.

Join my upcoming webinar, Co-living: The Smart Property Investor Strategy to learn about the cash flow positive investment strategy that is almost practically proof.

Disclaimer: The information in this blog is provided for educational purposes only. It does not constitute advice or recommendations and should not be relied on as such. You should obtain your own appropriate legal or financial advice relevant to your situation.